Real estate investing is an attractive option for individuals seeking to diversify their investment portfolios and potentially generate passive income, especially in the Philadelphia Metropolitan Area. However, it’s crucial to approach this venture with caution and knowledge. Our expert Century 21 Advantage Gold agents are here to help you throughout every step in your investing process. Let’s break down the key aspects of real estate investing that you should consider.

-

Set Clear Goals and Plan Your Strategy

Before you begin investing in real estate, it’s essential to define your goals and develop a solid investment strategy. Are you looking for short-term gains, long-term appreciation, or passive income through rental properties? You should determine your objectives and risk tolerance, and tailor your investment plan accordingly.

-

Choose the Right Location

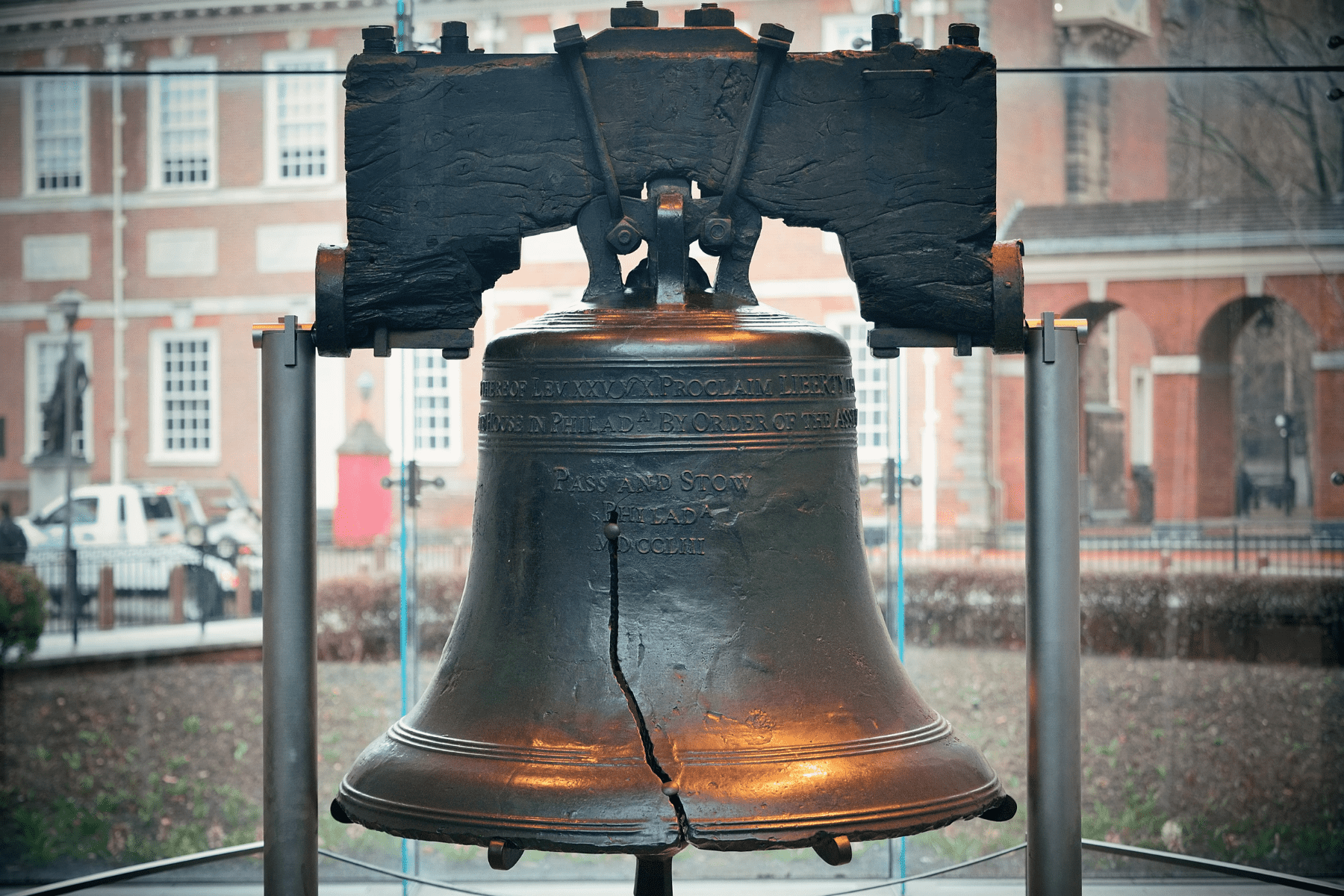

Location is paramount in real estate investing. Consider factors such as employment opportunities, access to amenities, and local infrastructure development when selecting a property. Research the area’s growth potential, rental yields, and vacancy rates to ensure you’re making a sound investment.

-

Build a Network of Professionals

Real estate investing is a team effort, and surrounding yourself with knowledgeable professionals is key to success. Your network should include an expert Century 21 Advantage Gold real estate agent, mortgage broker, attorney, property manager, and contractor. These experts can provide valuable advice and support throughout your investment journey.

-

Understand Your Financing Options

Securing the right financing is crucial for successful real estate investing. Familiarize yourself with various financing options, such as conventional loans, government-backed loans, and private financing. Evaluate the terms and conditions of each option and choose the one that best suits your financial goals and risk tolerance. Our Century 21 Advantage Gold agents are here to guide you through this process to make sure you are getting the best possible option.

-

Manage Your Risks

Real estate investments come with risks, including market fluctuations, vacancies, and unforeseen maintenance costs. Protect yourself by having a contingency fund, diversifying your portfolio, and conducting thorough property inspections. Adequate insurance coverage is also essential to shield yourself from potential losses.

-

Be Prepared for Ongoing Management

Owning rental properties requires ongoing management, including tenant screening, rent collection, and property maintenance. Decide whether you’ll manage your properties personally or hire a property management company. If you choose the latter, factor in the management fees when calculating your investment returns.

-

Think Long-term

Real estate investing is typically a long-term game, and it’s crucial to be patient and maintain a long-term perspective. Don’t be swayed by short-term fluctuations in the market, and be prepared to hold onto your properties through market cycles to maximize your returns.

Investing in real estate can be a lucrative endeavor, but it requires careful planning, research, and ongoing management, especially in the Philadelphia Metropolitan Area. By following these tips and with the help of our expert Century 21 Advantage Gold agents, you’ll be well on your way to building a successful real estate portfolio and enjoying the benefits of passive income and financial growth.